In FY 2020 US. Medicare boosted by 6 billion.

American Health Care Health Spending And The Federal Budget Committee For A Responsible Federal Budget

As the table suggests health care and K12 education represent Californias largest expenditures of state funds.

Us budget for healthcare. The federal government spent nearly 12 trillion on health care in fiscal year 2019 table 1. The Budget reforms the Departments programs to better serve and safeguard the American people while prioritizing key investments within them. Global health funding totaled 112 billion.

Federal spending for health programs is projected to total nearly 11 trillion in fiscal. Of the multilateral share the majority is provided to. In addition to these direct outlays various tax provisions for health care reduced income tax revenue by about 234 billion.

Funding for global health is provided bilaterally approximately 80. The Budget proposes 871 billion in discretionary budget authority and 12 trillion in mandatory funding for HHS. The proposed FY 2020 budget for the Department of Health Care Finance DHCF is 334 billion a 2 percent decrease from FY 2019 when adjusted for inflation.

Therefore the way budgets are formulated allocated and used in the health sector is at the core of the UHC agenda. Marketing budgets of US. Public Health is requesting around 535 million in local funding and 445 million in federal grants in aid for an overall public health budget of 9805.

Although health is financed by public and private funds to make progress toward universal health coverage UHC a predominant reliance on public compulsory prepaid funds is necessary. This includes a more than 900 billion cut to Medicaid a half a trillion-dollar cut to Medicare and more than 200 billion in cuts to other health programs. The legislature held a budget hearing Thursday morning for the Department of Public Health and Social Services which is asking for a significantly lesser budget for fiscal year 2022.

Guttmann Mar 24 2021 Out of the three types of healthcare companies. This chapter outlines the overall budget process for the public sector discusses the specific role of health within it in particular the role of the ministry of health and other health. Total US government estimated spending for 2021 is 816 trillion including a budgeted 483 trillion federal a guesstimated 203 trillion.

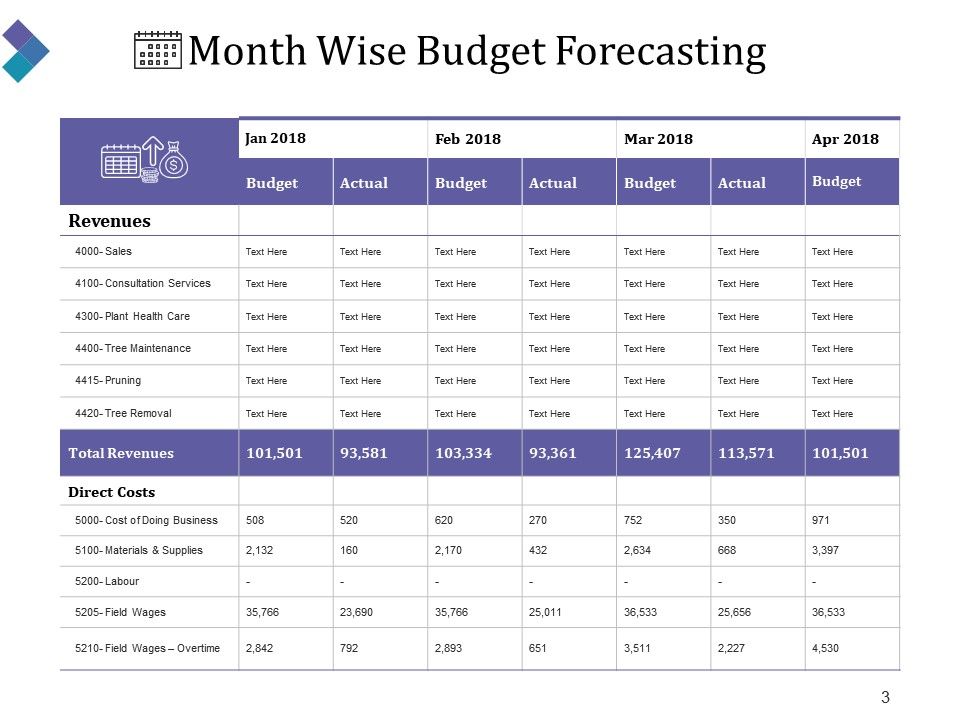

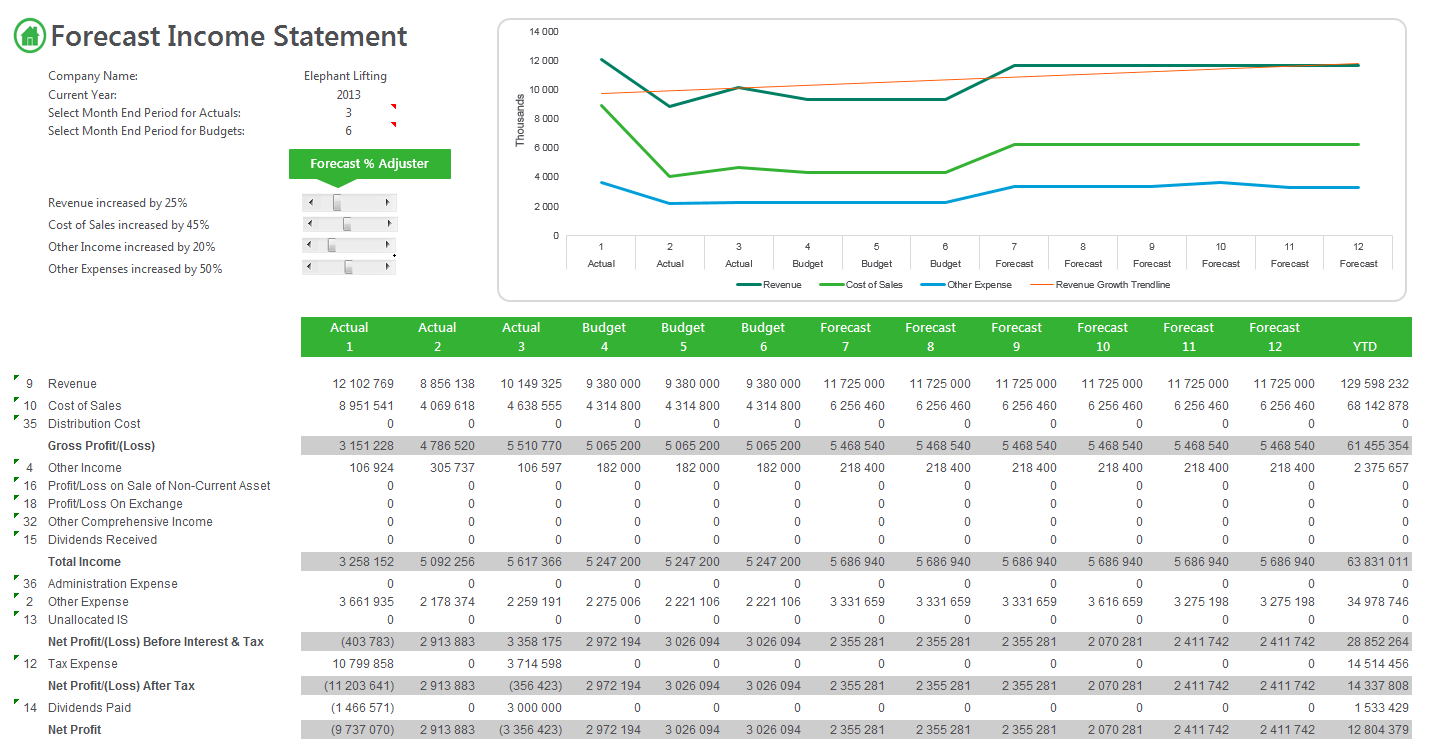

Budget process evolution and maturity in healthcare organizations traditionally has lagged other industries where leading-edge and data-driven forecasting approaches are currently evolving. Heres a snapshot of the health budget breakdown for 2019. As can be seen below Table 1 gives an overview of Californias 2017-2018 enacted state budget.

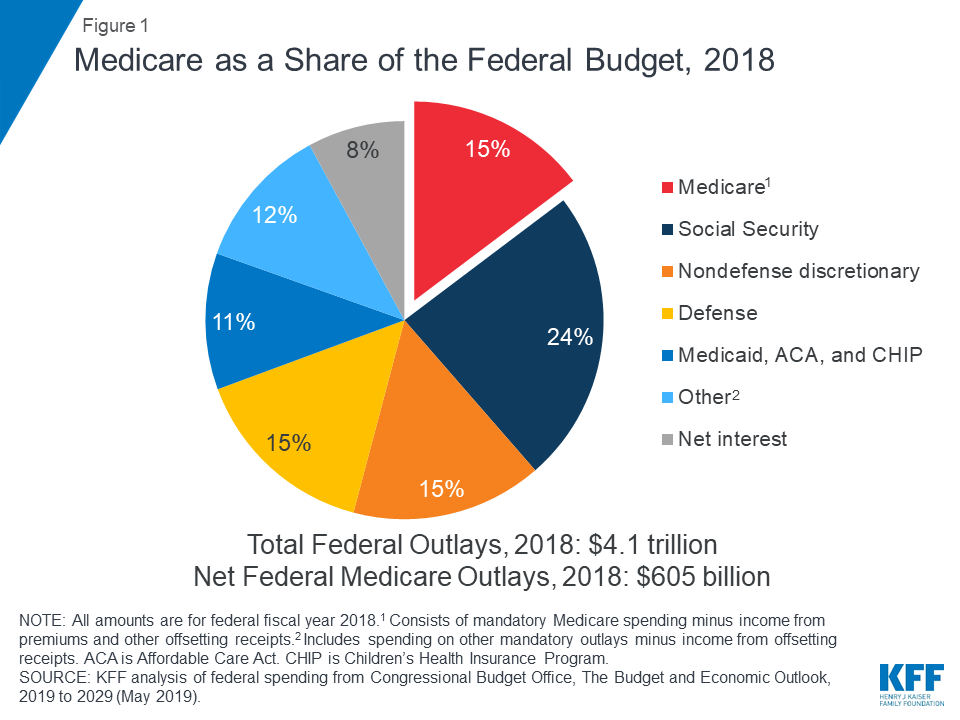

Of that Medicare claimed roughly 644 billion Medicaid and the Childrens Health Insurance Pro-gram CHIP about 427 billion and veterans medical care about 80 billion. 2019 Health Budget Snapshot. It reflects HHSs commitment to making the federal government more efficient and effective by focusing spending in areas with the highest.

Health care companies 2019-2020 Published by A. Most healthcare institutions today invest a significant amount of time and resources in an annual process with weeks spent negotiating a budget between department management and administration. CBO and JCT project that federal subsidies taxes and penalties associated with health insurance coverage for people under age 65 will result in a net subsidy from the federal government of 920 billion in 2021 and 14 trillion in 2030.

Overall the budget calls for a 95 billion cut to HHSs discretionary budget in 2021 and a 16 trillion cut over 10 years from mandatory health care spending. CMS in the report estimated that national health care spending reached 381 trillion in 2019 and would increase to 401 trillion in 2020. CMS projected that by 2028 health care spending would reach 619 trillion and would account for 197 of GDP up from 177 in 2018.

Health care is the fastest-growing type of federal spending having risen from 7 percent of the federal budget in 1976 to more than a quarter in fiscal year 2015 as health care costs have risen in the industrialized world. The Federal Government has announced a 104 billion investment into health in 201920 in the latest Federal Budget as part of a patient-focused health investment of 435 billion over the next four years. DHCF is DCs single largest agency in terms of gross funding accounting for 23 percent of the Districts 146 billion total budget.

The largest health care expenditure is for Californias Medi-Cal program a health insurance program for low-income families in California.