Fortunately there are sound financial strategies that can help you pay your debt off more quickly and reduce the overall amount youll end up paying. It will free up your income and help you sleep better at night among.

How To Pay Off Unexpected Medical Debt Dollarsprout

How To Pay Off Unexpected Medical Debt Dollarsprout

First and foremost SoFi Learn strives to be a beneficial.

Pay off medical debt. A silver lining for medical professionals who accumulate six-figure student loan debt is of course the likelihood of earning a very high income. The first reaction to medical debt may be to pay it off with a credit card. In fact medical debt is the top reason that people regardless of age would consider cashing in their 401 ks or other retirement savings TD Ameritrade found.

Paying off medical debt isnt as clear-cut as resolving other forms of debt such as a loan or credit card. When youre dealing with a medical emergency its hard not to see dollar signs every time. Sure you can do your best to live a healthy lifestyle to prevent large medical bills in.

You donate forgives 10000 in Medical Debt. June 27 2019 4 minute read Were here to help. Paying in full is better for your credit than settling.

The Medical Debt Relief Alliance. Before even considering debt settlement call the original service provider to discuss setting up a payment plan that will allow you to pay off all of your medical debt. Review each bill carefully to make sure youre not being overcharged or unfairly charged for.

Tapping your home equity or retirement accounts to pay off heavy medical debt can be tempting but the pitfalls can be serious. Options For Paying Off Medical Debt Set up a payment plan. Learn how other physicians are paying off debt.

Many medical providers allow you to set up interest-free payment plans for your bills. People commonly respond to medical debt by delaying vacations major household purchases cutting back on household expenses working more borrowing from friends and family and tapping retirement. Non-profit pays down medical debt A non-profit organization called RIP Medical Debt is buying and paying off outstanding medical bills for those in need.

Besides payment plans many medical providers give discounts to. However the interest is typically deferred. These allow you to charge your bill on credit and pay it off over time.

There are essentially two schools of thought on this issue. How Do I Pay Off Medical Debt. Put your family first.

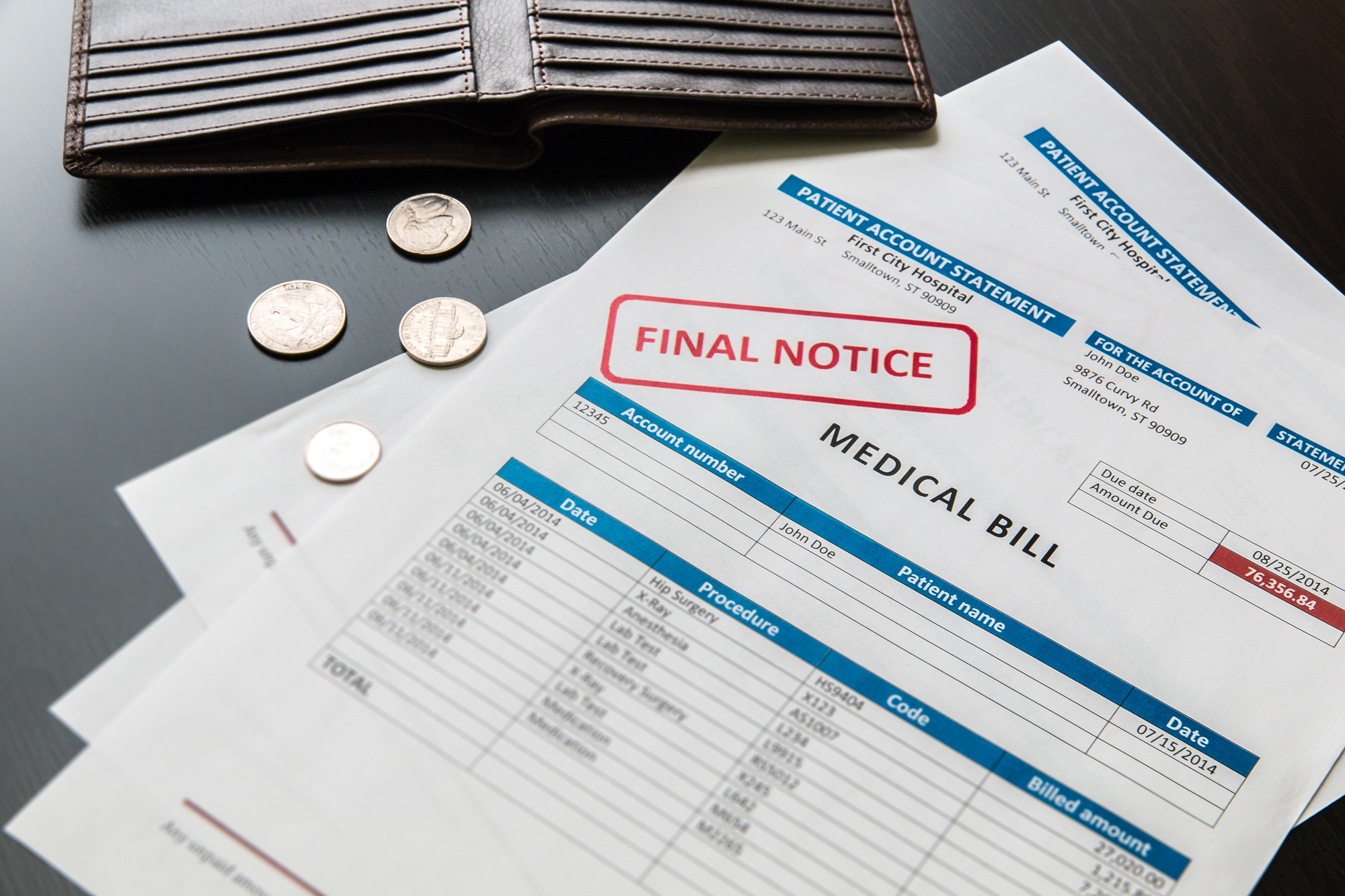

7 Tips for Paying Off Medical Debt and Avoiding Collections. Unpaid medical debt can lead to collections and damage to your credit. The thing that really stinks about medical debt is unlike consumer debt it cant always be prevented.

As with medical credit cards you are giving up the protections that come with debt classified as medical. A deductible is the amount that you must pay before insurance starts to kick in their portion of the funds. Some healthcare offices offer medical credit cards.

Medical school student debt is a burden that follows many physicians well into their career. These interest payments could lead to you paying hundreds or thousands of dollars more in interest plus the initial medical debt. Should you pay off student loans early.

Eradicate medical debt at pennies on the dollar. Paying off a ton of medical debt can be a very daunting task especially if youre living on a limited income. And even then raiding their.

Pay off your medical school loans ASAP. Certified credit counselors can help you decide which debt relief method is best for your financial. In addition these forms of.

There are ways to minimize debt pay it off and avoid negative impacts but youll need a strategy and a systematic approach to get the best outcome. EMBED THIS WIDGET ON YOUR SITE. However that is likely not the best solution to the problem.

ATLANTA - Its been more than a decade since Donna Dees blood sugar skyrocketed leading to a sudden diabetes diagnosis and two ICU stays. Join our community of monthly donors set on ending medical debt in America. This guide will help you.

If you pay your medical debt with a personal credit card then you run the risk of running into higher interest payments down the line. 5 Strategies to Help Pay Off Medical Debt. Usually they have an introductory period with a zero percent interest rate.

An HSA allows you to contribute up to 3550 annually which can be used to help cover any out-of-pocket medical expenses including hospital visits eligible health care costs dental care and even vision care. Still many physicians are then left wondering. Ask for a prompt payment discount.

Theres generally more room to negotiate the.