Its also possible a company can go into bankruptcy and that would hurt the returns of investors. To become an accredited investor you must fall into one of three categories.

Private Equity Career Path Hierarchy Promotions Salaries And More

Private Equity Career Path Hierarchy Promotions Salaries And More

Dont Buy Bitcoin Without Reading This.

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

How do you become a private equity investor. Perhaps the easiest way is to find a local company that can use some extra capital and buy in as a partner. There are two main ways for the average individual to become a private equity investor. Many venture capital firms charities and the like look for accredited investors as sanctioned by the SEC.

Entry-level positions are available but usually experience working in the financial sector is a requirement. A pure IR role contrasts quite distinctly with. No one can do everything well - including you.

Individuals who have an income greater than 200000 in each of the past two years or whose joint income with a. You need to ask yourself if you can do this alone via sole proprietorship or if you will need to join one or more individuals via. Securities Exchange Commission SEC has requirements for accredited investors like a 200000 minimum income in the last 2 years see Resources below.

KKR Thinks So KKR is actively pursuing retail investor dollars through a third. For instance growth investors will be more concerned about the long-term prospects and growth of a. Investor Relations is the panoptic of the investment community vis-à-vis stakeholders of the Private Equity Fund.

Look for a venture capital firm. You may find investors who. In the US an accredited investor is anyone who meets one of the below criteria.

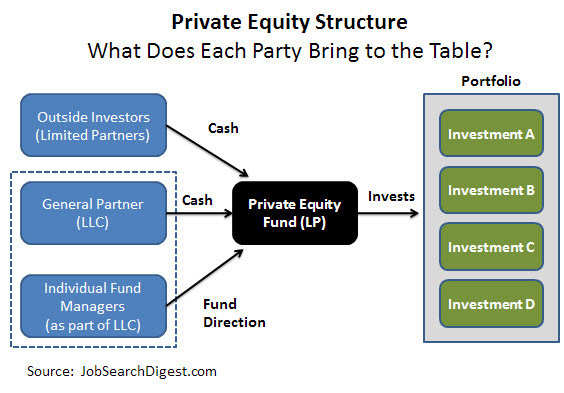

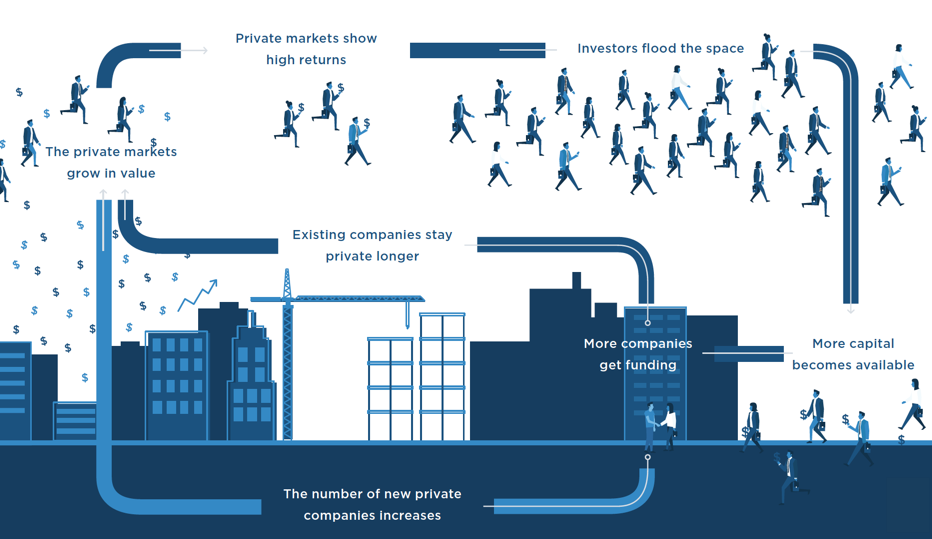

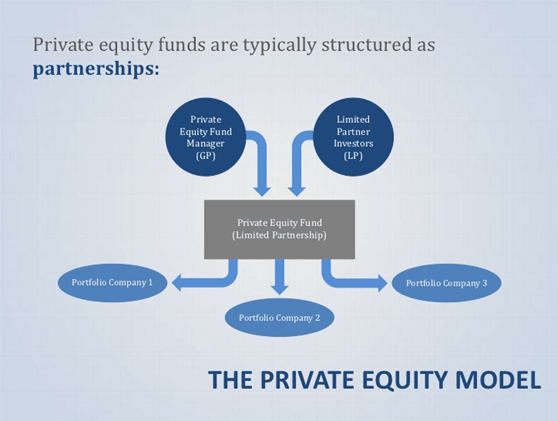

PE funds use investor capital to buy and add value to companies. Some firms also hire former management consultants. Investors seek out private equity PE funds to earn returns that are better than what can be achieved in public equity marketsBut there may be a few things you dont understand about the.

One way is through management fees and the another is through performance fees. Fill Gaps in Your Team. To become a private equity analyst you will need a bachelors degree in accounting finance or a related programme and sometimes an MBA as well.

This doesnt require that you qualify as an accredited investor -- a person with a net worth of 1 million or more and annual income of 200000 as an individual or 300000. The minimum investment in private equity funds is relatively hightypically 25 million although some are as low as 250000. Value can come from increasing sales and or cutting costs.

If you cant be away for a week without checking. Or possess certain credentials certifications or designations as recognized by FINRA. To directly invest in private equity youll need to work with a private equity firm.

If the company fails to grow PE investors will lose money. Sloppy numbers sap value like a poorly tuned engine saps horsepower. Do You Want to Become a Private Equity Investor.

It requires an individual with empathy and a real understanding of how to build long lasting relationships. The most important qualification to become a private equity analyst is two to three years prior experience as an investment banking analyst. Investors should plan to hold their private equity investment for at.

Have earned an income surpassing 250000 300000 if combined with a spouse or its equivalent during the last two years and prove an ability to maintain this income level. It is not a question of how well the target company is performing. Private equity funds make money in a couple of ways.

Knowing their investors needs and requirements is of the essence for Fund Managers to be able to build long-term investor relationships. Funds collect management fees just for owning and managing the target company. These firms will have their own investment minimums areas of.

As an accredited investor you. Understand How You Work -- Alone and With Others. The goal is for the private-equity fund and its investors to make money when a target company is sold.

Have a net worth exceeding 1 million on your own or with a spouse or its equivalent. The most common way to get into private equity is via investment banking. 10 Ways to Attract Private Equity Audit Your Financials.

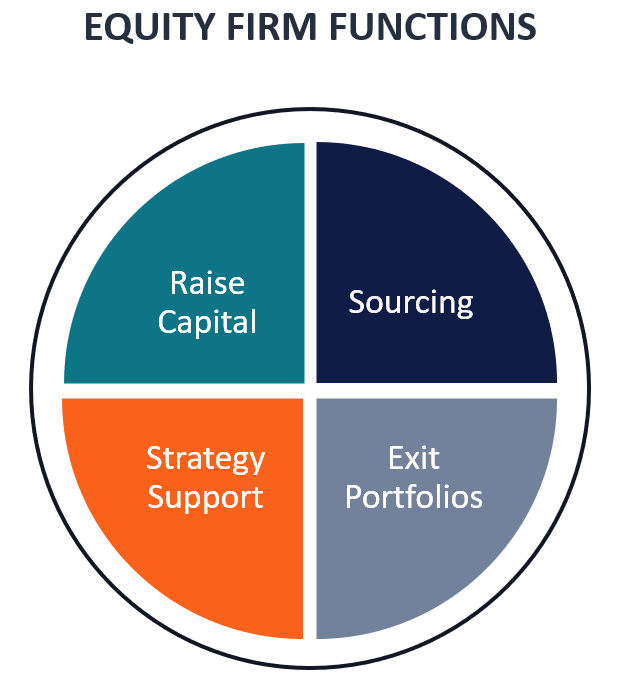

Equity Firm Overview Functions And Roles Of Pe Firms

Equity Firm Overview Functions And Roles Of Pe Firms

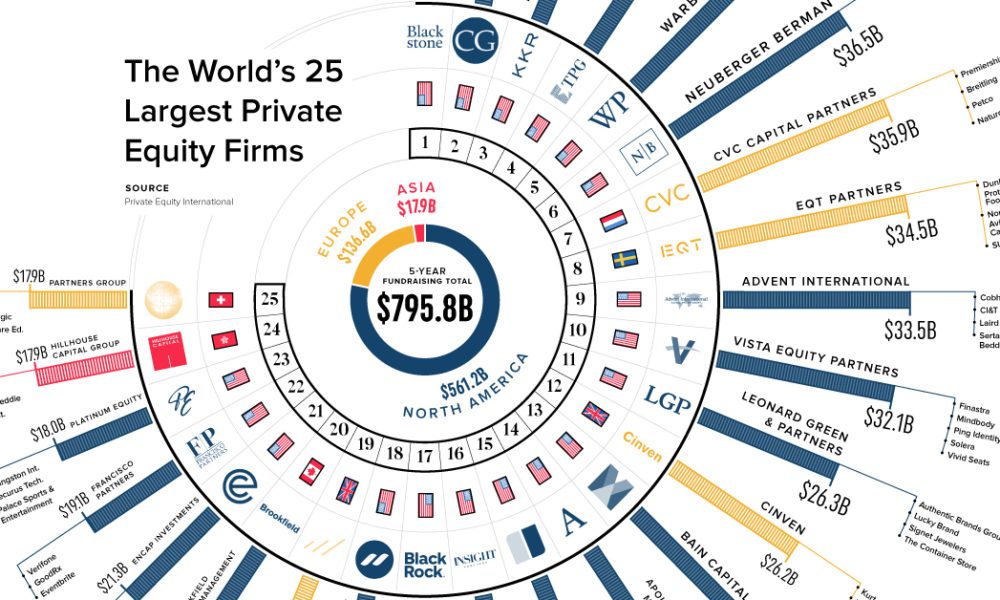

Visualizing The 25 Largest Private Equity Firms In The World

Visualizing The 25 Largest Private Equity Firms In The World

Carried Interest Guide For Private Equity Professionals

Carried Interest Guide For Private Equity Professionals

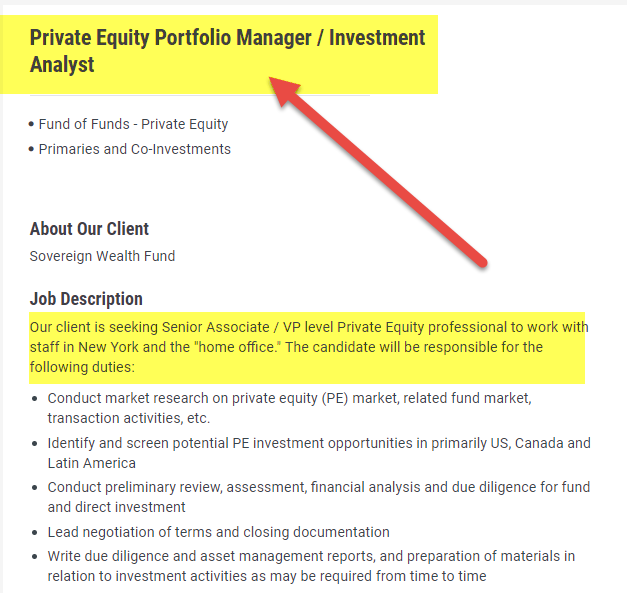

How To Get Into Private Equity A Complete Beginner S Guide

How To Get Into Private Equity A Complete Beginner S Guide

Private Equity Career Path Hierarchy Promotions Salaries And More

Private Equity Career Path Hierarchy Promotions Salaries And More

How A Private Equity Firm Works Street Of Walls

Private Equity Vs Venture Capital What S The Difference Pitchbook

Private Equity Vs Venture Capital What S The Difference Pitchbook

/GettyImages-1156715223-b8aab9f507bf4ea3bbc73cb13319d469.jpg) How To Become A Private Equity Associate

How To Become A Private Equity Associate

Career Guide To Private Equity Jobs What You Need To Know

Career Guide To Private Equity Jobs What You Need To Know

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.