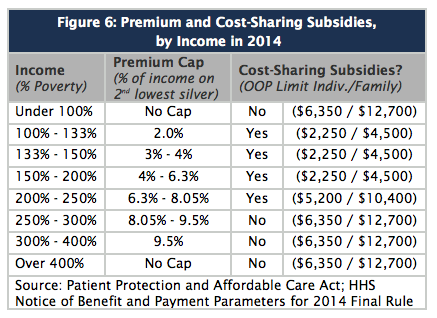

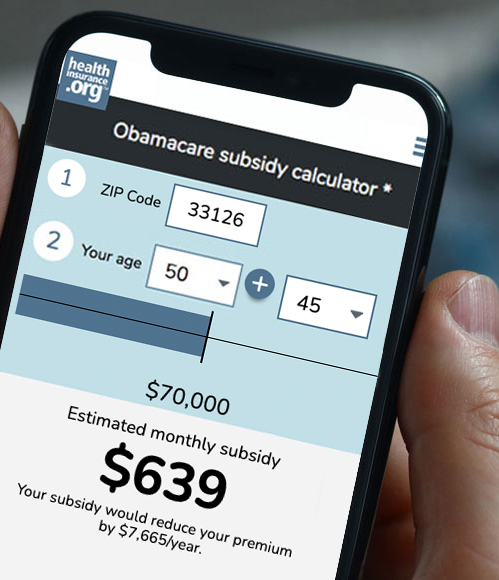

For people with income up to 150 of the poverty level the after-subsidy premium is 0 for the lowest-cost and second-lowest-cost silver plan in 2021 and 2022. If your income is below 250 of the federal poverty level you can qualify for a cost-sharing subsidy in addition to the premium subsidy.

How Will The Affordable Care Act S Cost Sharing Reductions Affect Consumers Out Of Pocket Costs In 2016 Commonwealth Fund

How Will The Affordable Care Act S Cost Sharing Reductions Affect Consumers Out Of Pocket Costs In 2016 Commonwealth Fund

The other directly reduces cost-sharing requirements eg lowers a deductible.

Aca cost sharing subsidies. You qualify for subsidies if pay more than 85 of your household income toward health insurance. The two types are. No the cost-sharing reductions increase the actuarial value of a standard silver plan which results in lower out-of-pocket charges.

Beginning in 2013 cost-sharing reduction CSR subsidies were paid to insurance companies to reduce deductibles co-payments and coinsurance for households making between 100 and 250 percent of the federal poverty level who purchased a silver-tiered plan on the insurance exchanges created by the Patient Protection and Affordable Care Act ACA. The ACA established two types of cost-sharing reductions CSRs. For those enrollees premium subsidies cover the bulk of their premiums.

In most states insurers have significant flexibility to set these charges. To raise awareness the Biden administration is doubling its advertising budget to 100 million and launched a new ad highlighting the availability of no-cost or low-cost plans thanks to the. Specific cost-sharing charges will vary from silver plan to silver plan with the same actuarial value.

1Federal Premium Subsidies and 2 Federal Cost-Sharing Subsidies. The ACAs cost-sharing reductions CSRs mean lower copayments and deductibles for people in households earning between 100 percent and 250 percent of the federal poverty level about 12000 to 30000 for an individual and about 24000 to 60750 for a family of four. To learn about the other form of subsidy read Do I Qualify for Premium Subsidies.

1 The federal government reimburses insurers for providing the subsidies which in 2016 totaled 7 billion. Of those 96 million or 84 percent received premium subsidies. 2000 deductible per person 6350 annual out-of-pocket maximum per person 45 co-pay for primary care visits 19 co-pay for generic drug prescription 20 co-insurance for hospital stays.

Along with Premium Tax Credits ObamaCares Cost Sharing Reduction subsidies lower what you pay for out-of-pocket costs like deductibles copays and coinsurance making health insurance coverage more affordable and. Who is eligible for ACA cost-sharing subsidies. Cost-sharing subsidies are only available on silver plans and are automatically included in all of the available silver plans if your income makes you eligible for them.

One type of subsidy reduces annual cost-sharing limits. These 7 billion in subsidies help roughly 7 million Americans afford healthcare coverage. If you already enrolled in an ACA plan and got a subsidy you can change your plan and get the added savings.

Individuals who receive premium credit payments also may be eligible for subsidies that reduce cost-sharing expenses. When you fill out a Marketplace. If you qualify you must enroll in a plan in the Silver category to get the extra savings.

For those not eligible the plans that include cost-sharing subsidies dont show up in the available options. For 2021 the income cut-off is. Premiums will drop on average about 50 per person per month or 85 per policy per month.

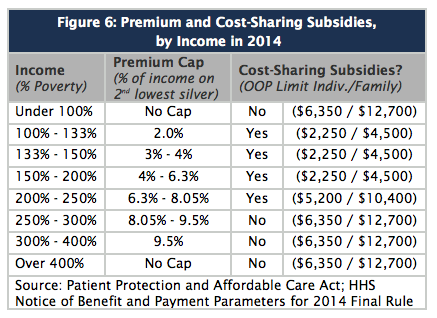

The Affordable Care Act commonly known as ObamaCare offers two types of subsidies to help reduce costs. Last night the Trump administration continued its dismantling of the Affordable Care Act ACA by eliminating cost-sharing subsidies to insurance companies. Regular Silver plan.

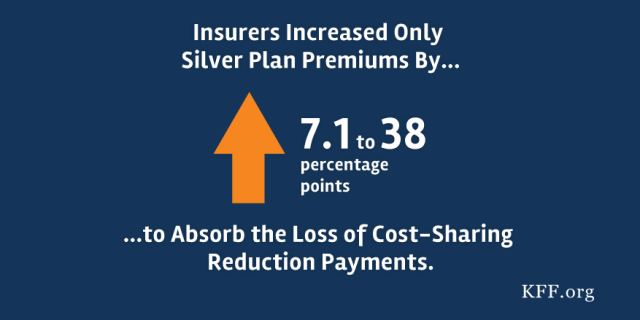

Native American cost-sharing reductions Members of Federally Recognized Indian tribes benefit from another set of cost-sharing benefits. The average full-price plan across the 38 states that used HealthCaregov in 2020 was 595month but the average after-subsidy premium was just 145month. ObamaCares Cost Sharing Reduction Subsidies CSR lower out-of-pocket costs based on income for Silver plans bought on the Health Insurance Marketplace.

The American Rescue Plan makes it easier for lower-income enrollees to afford a silver plan by enhancing the premium subsidies and thus bringing down the after-subsidy cost of these plans. Cost Sharing Reduction CSR A discount that lowers the amount you have to pay for deductibles copayments and coinsurance. Those households who fall under one of these groups qualify for zero cost-sharing plans as long as their household income is.

This article is dedicated to Cost-Sharing Subsidies. In the Health Insurance Marketplace cost-sharing reductions are often called extra savings.

2018 Cost Sharing Reduction Subsidies Csr

2018 Cost Sharing Reduction Subsidies Csr

How Will The Affordable Care Act S Cost Sharing Reductions Affect Consumers Out Of Pocket Costs In 2016 Commonwealth Fund

How Will The Affordable Care Act S Cost Sharing Reductions Affect Consumers Out Of Pocket Costs In 2016 Commonwealth Fund

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

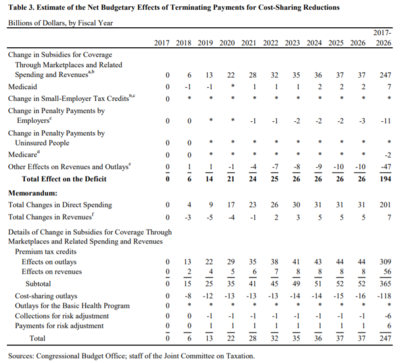

Federal Cost Sharing Subsidies To Insurers Are Reduced What Are The Real Impacts

Federal Cost Sharing Subsidies To Insurers Are Reduced What Are The Real Impacts

How The Loss Of Cost Sharing Subsidy Payments Is Affecting 2018 Premiums Kff

How The Loss Of Cost Sharing Subsidy Payments Is Affecting 2018 Premiums Kff

Cost Sharing Subsidy Health Choice One

Cost Sharing Subsidy Health Choice One

The Aca S Cost Sharing Subsidies Healthinsurance Org

The Aca S Cost Sharing Subsidies Healthinsurance Org

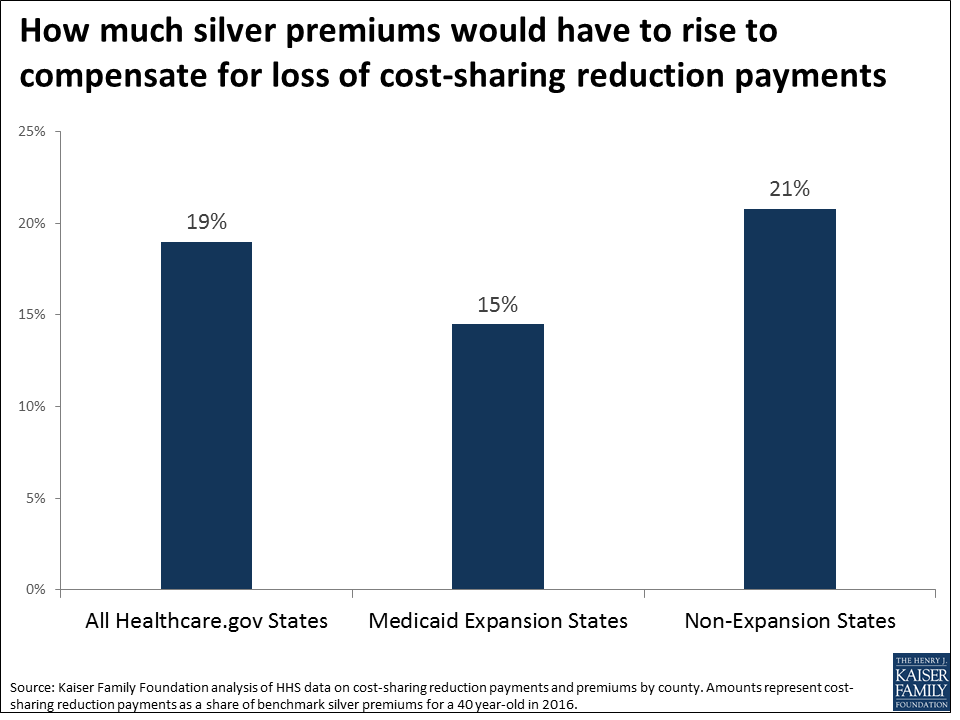

Estimates Average Aca Marketplace Premiums For Silver Plans Would Need To Increase By 19 To Compensate For Lack Of Funding For Cost Sharing Subsidies Kff

Estimates Average Aca Marketplace Premiums For Silver Plans Would Need To Increase By 19 To Compensate For Lack Of Funding For Cost Sharing Subsidies Kff

What Is The Affordable Care Act Cost Sharing Subsidy Obamacare Turbotax Tax Tip Video Youtube

What Is The Affordable Care Act Cost Sharing Subsidy Obamacare Turbotax Tax Tip Video Youtube

How Does Your Income Affect The Cost Of Your Marketplace Plan Healthcare Counts

How Does Your Income Affect The Cost Of Your Marketplace Plan Healthcare Counts

Improving Aca Subsidies For Low And Moderate Income Consumers Is Key To Increasing Coverage Center On Budget And Policy Priorities

Improving Aca Subsidies For Low And Moderate Income Consumers Is Key To Increasing Coverage Center On Budget And Policy Priorities

How Will The Affordable Care Act S Cost Sharing Reductions Affect Consumers Out Of Pocket Costs In 2016 Commonwealth Fund

How Will The Affordable Care Act S Cost Sharing Reductions Affect Consumers Out Of Pocket Costs In 2016 Commonwealth Fund

The Aca S Cost Sharing Subsidies Healthinsurance Org

The Aca S Cost Sharing Subsidies Healthinsurance Org

Cost Sharing Reductions Subsidy Wikipedia

Cost Sharing Reductions Subsidy Wikipedia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.